How Do Boutique Retirement Plan Administrators Compare to Big Box Self-Directed IRA Custodians?

Key Takeaways

Switching custodians mid-investment is possible — we've rescued deals in progress when big institutions couldn't perform.

Having multiple IRAs with different custodians is perfectly legal and often the smartest strategy for sophisticated investors.

The best time to establish a relationship with a boutique custodian is before you find your next investment opportunity.

Last month, a hedge fund principal called me at 4:47 PM on a Thursday. His private equity group had issued a capital call with 10 business days to fund or face penalties up to 103% of his investment value.

His IRA was already with a household-name institution. But when he called to process the investment, they needed 3-4 weeks just to review his private equity documentation, plus additional processing time.

He was looking at over a month to meet a capital call that closed in 10 days.

After three decades as a retirement plan administrator, I've seen this scenario hundreds of times. We opened and funded his account at CTAS in eight days. You can avoid the time crunch panic with a boutique self-directed IRA custodian.

The Reality of Working with Large Institutional Custodians

When you call your large institutional self-directed IRA custodian, you enter what I call "call center roulette." Today it's Jennifer. Tomorrow it's Michael. Next week, someone whose name you didn't catch because you were explaining your situation for the fourth time.

Each representative reads from the same script, none remembers previous conversations, and none has actual experience with the self-directed investment options you're pursuing.

What "Self-Directed" Really Means at Big Institutions

These institutions won't tell you upfront: their "self-directed" programs mean choosing from a pre-approved menu of alternative investments.

Some common limitations include:

Local real estate must fit the checkbox criteria

Private placements require weeks of committee reviews

Many alternatives get rejected after 6+ week waits

Limited expertise in complex deal structures

The 30-60 day timeline isn't an exception; it's standard operating procedure.

How Big Custodians Handle Alternative Investment Requests

Let me pull back the curtain on what typically happens when you try to invest in alternatives through a large institutional custodian.

The Approval Maze

When you submit an investment request for something beyond stocks and bonds, your documentation enters a complex review system:

Weeks 1-2: Initial compliance screening

Weeks 2-3: Legal department review

Weeks 3-4: Investment committee evaluation

Weeks 4-5: Final approvals and processing

Each department operates in isolation. Your private equity opportunity sits in legal's queue while compliance waits for their weekly meeting. Nobody owns the entire process, and nobody feels the urgency of your deadline.

Your sophisticated private equity investment is an anomaly in their system, requiring multiple reviews and often ending with "we're not comfortable with this investment" after you've waited six weeks.

The CTAS Difference: Boutique Service for Sophisticated Investors

At Chicago Trust Administration Services, we operate on a different timeline because we operate with a different philosophy. We believe sophisticated investors deserve a partner — not a gatekeeper — who understands their deals.

Every investment opportunity is unique, and our job is to help you execute it compliantly without bureaucratic delays.

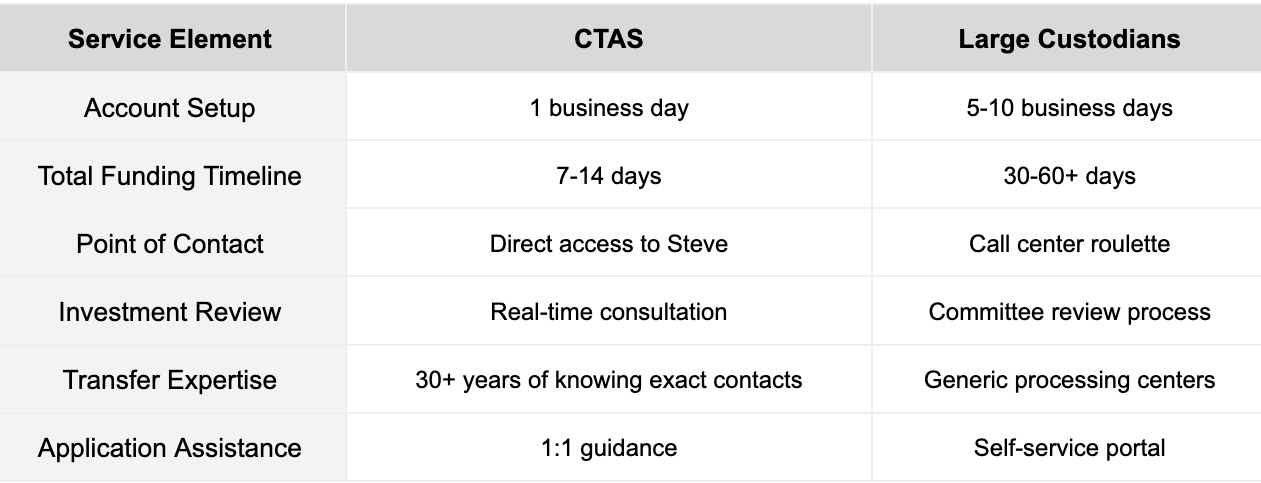

Our Service Standards vs. Industry Norms

Our 7-14 day timeline isn't a marketing promise; it's how we work. The bulk of that time is spent waiting for funds to transfer from your existing custodian. Our actual account setup typically happens in one business day.

The Personal Touch That Makes the Difference

When you work with CTAS, you work directly with me. Not a call center representative reading from a script, but someone with three decades of experience in:

Residential and commercial real estate

Mortgage financing

Alternative investments

Complex deal structuring

Many clients overthink the application process, second-guessing every answer they provide. During our one-on-one application assistance, I help you fast-forward through these decisions. I've seen thousands of applications, and I know exactly what information matters and what's just paperwork anxiety.

Why Speed and Expertise Matter for Alternative Investments

Let's go back to our hedge fund principal; he had just 10 days to fund his part of the capital call.

Private equity capital calls don't operate on institutional timelines. When a subscription offering opens for a successful PE group, it often becomes oversubscribed within days.

Consequences of missing deadlines:

Penalties up to 103% of your investment amount

Loss of investment opportunity

Damaged relationships with deal sponsors

Exclusion from future opportunities

Forfeiture of committed capital

Real estate operates on similar urgency. In competitive markets, sellers won't wait 30-60 days for your custodian to decide whether they're comfortable with the investment. While your big-box administrator is still reviewing documentation, cash buyers and investors with responsive custodians have already closed.

It goes beyond individual deals, too. It can negatively impact your reputation as an investor and limit future opportunities.

Making the Switch: Your SDIRA Custodian Transfer Roadmap

Ready to experience the difference a true self-directed IRA custodian can make?

What You'll Need to Get Started

Required Documents:

Most recent account statement

Valid government-issued ID

15 minutes for initial consultation

That's it. No extensive paperwork packages, no weeks of back-and-forth documentation requests.

Navigating the Transfer Process

When you transfer your IRA to CTAS, several things need to happen in precise sequence. Here's where my experience pays off:

Common transfer obstacles I prevent:

Wrong signature format (wet signatures vs. DocuSign)

Incorrect mailing addresses (some institutions have separate addresses for IRA transfers)

Account titling discrepancies that can cause silent rejections

Processing delays — I know exactly which department and person to contact at major custodians.

My 30+ years in this business mean I prevent these hiccups before they become week-long delays.

How We Expedite Your Transfer

Our parallel process approach:

Immediate Transfer Initiation: We request funds from your current custodian while setting up your new account simultaneously.

Daily Tracking: I personally monitor your transfer, not weekly automated updates.

Direct Problem-Solving: When custodians claim missing paperwork, I call and confirm receipt immediately.

Continuous Communication: You have my direct line for updates.

No ticket systems. No hold music. Just straightforward communication from someone who's guided thousands of investors through this exact process.

How Chicago Trust Administration Services Can Help

At Chicago Trust Administration Services, we combine decades of expertise with responsive, personal service to the time-sensitive and sophisticated demands of your investment strategy. To see how we can help, we invite you to schedule a complimentary meeting with us by calling 312-869-9394 or emailing steve@ctasira.com.

Your self-directed IRA deserves more than processing — it deserves a true partner.

Frequently Asked Questions (FAQs)

Q: Can I transfer just part of my IRA to CTAS for a specific investment?

A: Yes, you can maintain your existing IRA and transfer only the funds needed for your self-directed investment if that best fits your strategy.

Q: What types of alternative investments does CTAS actually approve?

A: We handle real estate, private equity, private placements, LLCs, and most alternative investments that comply with IRS regulations. If it's legal, we'll help you execute it.

*The content and opinions in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

**CTAS professionals are not financial advisors and cannot provide advice or recommendations regarding specific investment decisions.