When to Deploy Your Self-Directed IRAs' Best Defense Against Market Volatility

Key Takeaways

Sophisticated SDIRA investors who build lasting wealth rebalance strategically when risk-reward ratios shift rather than trying to time exact market tops.

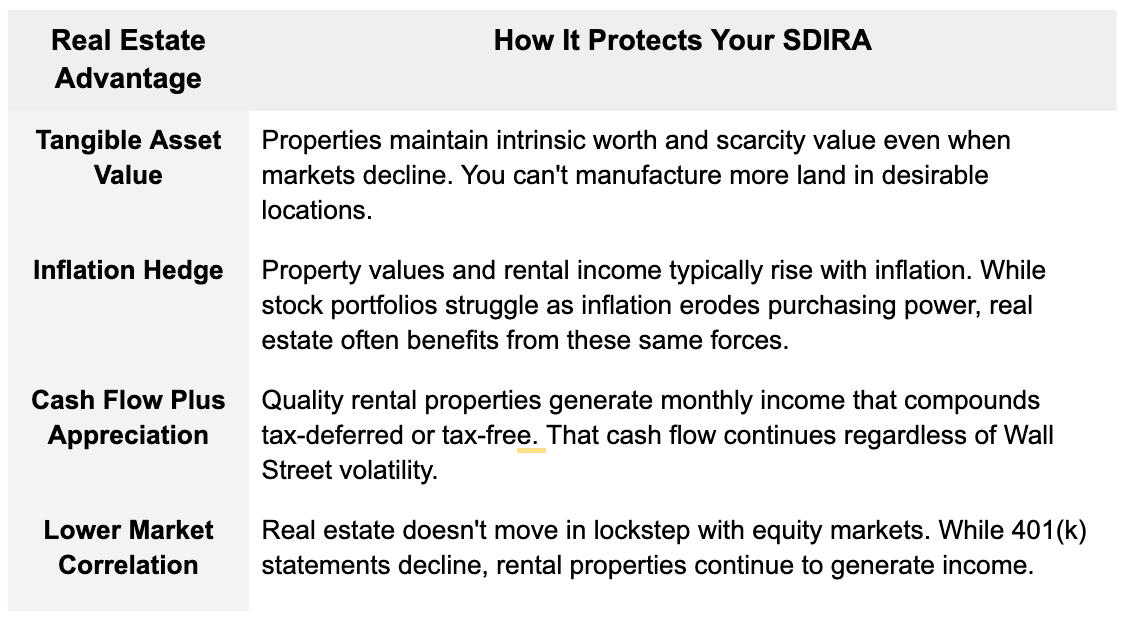

Real estate investments offer multiple layers of protection during volatility, including tangible asset value, inflation hedging, consistent income generation, and low correlation with equity markets.

Strategic rebalancing from appreciation-focused holdings into income-generating real estate during market extremes is a time-tested approach to preserving wealth through market fluctuations.

After 30 years of structuring self-directed IRA real estate transactions, I've watched sophisticated investors ride market cycles all the way up and, unfortunately, all the way back down. Those who build lasting wealth understand the need for strategic rebalancing when risk-reward ratios shift.

Right now, I’m seeing some of those classic market peak indicators — high valuations, speculative investor behaviors, and other warning signs that could signal a correction on the horizon.

When this happens, experienced SDIRA investors begin to think differently about portfolio positioning. The question isn't whether to adjust strategy, but how to do it while preserving tax advantages and staying compliant with self-directed IRA real estate rules.

Reading the Market Signals After 30+ Years

In my experience, the investors who handle volatility successfully aren't the ones trying to predict exact market tops. They're the ones who stay aware of changing conditions and make measured adjustments based on their overall strategy and risk tolerance.

When you start noticing valuation extremes or shifts in market sentiment, that's your signal to review your SDIRA allocation. Are you comfortable with your current risk exposure? Does your portfolio still align with your goals? Are you over-concentrated in assets that could decline sharply?

At times like these, many sophisticated investors opt to rebalance by reallocating some capital from appreciation-focused holdings into income-generating assets, such as real estate. This isn't panic — it's prudent portfolio management.

Recognizing When Strategic Adjustments Make Sense

I've helped clients restructure their SDIRA holdings through multiple market cycles. During volatile periods, cash flow real estate investments consistently demonstrate advantages that paper assets simply can't match:

How I've Helped Clients Restructure During Volatility

Let me share an example from the last major market peak. One of my clients achieved substantial gains in a concentrated stock position within his self-directed IRA through excellent early-stage investments.

When we started seeing warning signs in 2021 — extreme valuations, speculative trading behavior, and signs of market froth — I had a conversation with him about rebalancing. The stock holdings had grown to represent 80% of his SDIRA value. He was uncomfortable with that concentration but hesitant to sell winners.

We worked through the math together. Taking profits meant recognizing gains, but inside the self-directed structure, there were no immediate tax consequences. We could redeploy that capital into cash flow real estate investments while preserving the tax advantages.

He sold roughly half his position and used those proceeds to acquire two multi-family properties in a strong rental market. He purchased the properties at reasonable valuations with solid fundamentals, positive cash flow from day one, and tenants already in place.

When the market correction came in 2022, his stock holdings declined along with the broader market. His rental properties kept generating monthly income. The cash flow helped stabilize his portfolio and gave him dry powder for future opportunities.

More importantly, he could sleep at night knowing his retirement wasn't entirely dependent on market sentiment.

That restructuring protected substantial wealth and positioned him to benefit from both income and appreciation going forward. The key was acting when signals indicated elevated risk, not waiting until everyone else recognized the problem.

Understanding Self-Directed IRA Real Estate Rules

This strategy is effective, but success depends on strict compliance with the rules governing self-directed IRA real estate investments. These regulations exist to protect your account's tax-advantaged status, and violations can trigger disqualification.

Here’s a refresher on compliance requirements:

Prohibited Transactions: You cannot buy property from or sell property to yourself, your spouse, your parents, your children, or certain other related parties. You also cannot use the property personally.

All Expenses Through the IRA: Every dollar — income or expense — must flow through the SDIRA.You cannot pay property taxes from your personal checking account, even if you plan to reimburse yourself later.

Professional Management Required: You can manage the investment decisions, but all maintenance, repairs, and property management must be handled by third parties and paid for by the SDIRA.

Adequate Reserves: Your SDIRA must maintain sufficient cash reserves to handle 3-6 months of property expenses. Vacancies are inevitable, and repairs happen at inconvenient times.

The complexity of these regulations makes working with an experienced self-directed IRA custodian non-negotiable. Even sophisticated investors benefit from expert guidance to ensure every transaction maintains compliance.

Strategic Timing Isn't Market Timing

Strategic portfolio rebalancing based on risk assessment is fundamentally different from trying to predict short-term market movements. When valuations reach extremes or risk-reward ratios shift dramatically, act accordingly.

Investors who preserve wealth over decades take profits when assets become overvalued and reposition for better risk-adjusted returns. Cash flow real estate investments offer precisely this kind of strategic alternative when equity markets look stretched.

Taking Action with Professional Support

If market signals indicate it's time to reposition your SDIRA holdings, start by evaluating your current allocation and exposure to assets that could decline sharply. Then consider which real estate opportunities align with your goals, risk tolerance, and generate strong cash flow fundamentals.

At Chicago Trust Administration Services, we take a consultative approach to helping clients make these strategic decisions. We help you understand the regulatory framework, structure compliant transactions, and avoid prohibited transaction pitfalls.

Taking profits when assets are near peaks and redeploying into cash flow real estate investments is a time-tested strategy for preserving wealth through market cycles.

To see how we can help, we invite you to schedule a complimentary meeting with us by calling 312-869-9394 or emailing steve@ctasira.com.

Frequently Asked Questions (FAQs)

Q: Can I use leverage (a non-recourse loan) when purchasing real estate in my SDIRA?

A: Yes, you can use non-recourse financing for SDIRA real estate purchases. However, this may trigger Unrelated Debt-Financed Income (UDFI) tax on the leveraged portion of rental income and gains. Your custodian can help you understand the tax implications and determine if leverage makes sense for your specific situation.

Q: How long does it typically take to restructure SDIRA holdings from stocks to real estate?

A: The timeline varies based on your current holdings' liquidity and target property availability. Selling publicly traded securities usually takes 2-3 business days to settle. Finding and closing on suitable real estate can take 30-90 days.

*The content and opinions in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

**CTAS professionals are not financial advisors and cannot provide advice or recommendations regarding specific investment decisions.