Traditional vs. Roth SDIRA Real Estate: Why Tax-Free Growth Changes Everything

Key Takeaways

Real estate in a Roth SDIRA is like an annuity that never dies — generating tax-free income for you and your heirs indefinitely.

Most successful real estate investors aren't in lower tax brackets during retirement, as they often expect.

Converting a $500,000 property portfolio to Roth might cost $150,000 today, but save you taxes on millions in future growth and income.

I recently sat down with a client who built a $3 million real estate portfolio inside his traditional self-directed IRA. He was rightfully proud — but not so much when we calculated his future tax liability. "I wish I’d gone with the Roth option," he said. It's a conversation I've had too many times over my 30+ years in real estate financing.

The most sophisticated real estate investors are experts in cap rates and cash flow. Yet, many overlook the fundamental decision between traditional or Roth SDIRAs. This choice can mean the difference between a comfortable retirement and lasting generational wealth.

After administering thousands of self-directed IRA real estate transactions, I've watched tax-free growth transform ordinary rental portfolios into extraordinary wealth-building powerhouses. When you understand how a Roth SDIRA changes the mathematics of real estate investing, you'll see why my most successful clients prioritize Roth accounts for income properties.

The Fundamental Difference That Changes Everything

With traditional SDIRAs, you're building what I call a "tax time bomb" — every rent check and every dollar of appreciation creates future tax liability that compounds silently in the background.

The reality hits hardest at age 73 when Required Minimum Distributions kick in. These forced withdrawals don't care about market conditions or your income needs. I've watched investors forced to sell properties during downturns just to meet RMD requirements, destroying years of careful portfolio building.

Consider a $2 million rental portfolio in a traditional SDIRA. At age 75, your RMD might be $87,000 — all taxable income that stacks on top of other retirement income. One client discovered his effective tax rate on SDIRA real estate income exceeded 35%!

Now imagine that same portfolio in a Roth SDIRA: because contributions are made post-tax, every dollar of rental income flows in tax-free forever. No RMDs forcing your hand at 73. No strategic property sales disrupted by tax considerations. When you take distributions, they remain tax-free. This isn't just a tax advantage but a fundamental restructuring of how wealth compounds and transfers.

Income Properties: Where Roth SDIRAs Truly Shine

Unlike appreciation plays that might pay off years down the road, rental properties generate immediate monthly cash flow — and how that cash flow is taxed makes all the difference in your long-term wealth accumulation.

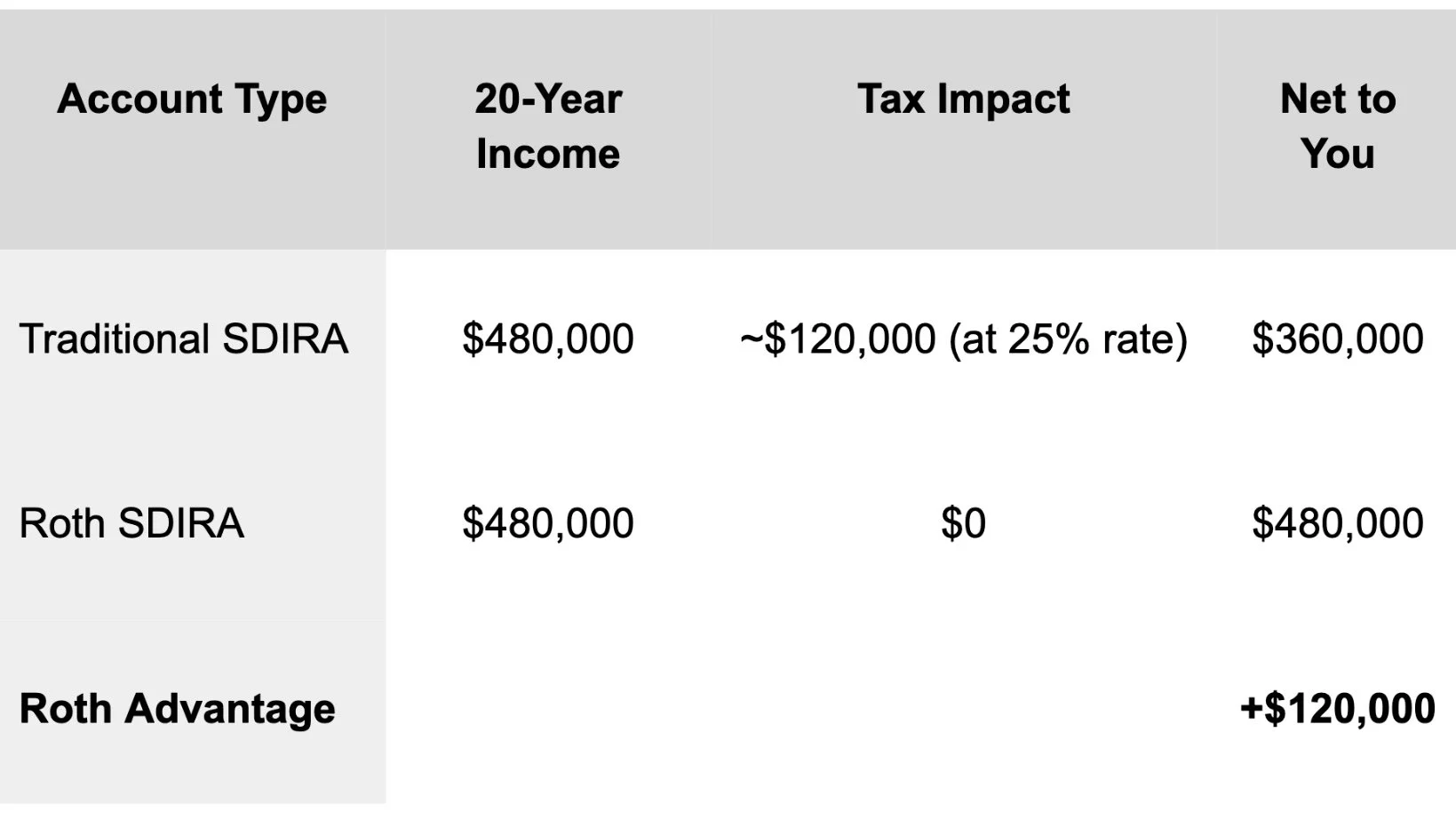

Let's look at a rental property generating $2,000 monthly profit after expenses:

The Monthly Cash Flow Comparison

The real power emerges when reinvesting those tax-free profits. One client started with a duplex generating $1,500 monthly in her Roth SDIRA. Eight years later, she owns four properties generating $7,000 monthly — all tax-free. In a traditional SDIRA, she'd need to reserve 25-35% for future taxes, limiting reinvestment capacity.

Long-Term Wealth Building and Estate Planning

Real estate is like an annuity, but much better. An annuity's income dies with you, but Roth SDIRA real estate continues to generate tax-free retirement income for your beneficiaries.

According to current IRS guidance, non-spouse beneficiaries who inherit IRAs from owners who passed away in 2020 or later must generally withdraw the full balance within 10 years. This creates vastly different outcomes:

Traditional SDIRA inheritance: Every distribution your heirs take is fully taxable — often when they're in their peak earning years and highest tax brackets.

Roth SDIRA inheritance: Your beneficiaries can collect tax-free rental income for up to 10 years before distributing the properties. They inherit both the properties AND the tax-free status.

I've helped clients structure multi-generational wealth strategies around this concept. The rental income can support the next generation while they build their own careers and businesses.

When Roth SDIRAs Make Sense for Real Estate

After thousands of consultations, clear patterns emerge for optimal Roth SDIRA use:

Ideal Candidates:

Investors with 15+ year time horizons

High earners planning for comparable retirement income

Focus on cash flow over quick flips

Estate planning priorities

Those building multiple property portfolios

Perfect Property Types:

Stable rental properties in growing (but not speculative) markets

Small multiplexes with consistent occupancy

Properties requiring minimal renovation

Geographic diversification opportunities

The Roth Conversion Question

Many clients holding traditional SDIRA properties ask about Roth conversions. Yes, you'll pay taxes on the conversion amount, but the long-term mathematics often justify the short-term pain. Converting a $500,000 property portfolio might trigger $150,000 in current taxes. But if that portfolio grows to $2 million over 15 years while generating $400,000 in rental income, you've avoided taxes on $1.9 million in gains and income.

Strategic timing makes all the difference. Convert during market downturns when property values temporarily dip, or during lower-income years between ventures.

Common Misconceptions to Address

Even sophisticated investors come to me with the same misconceptions. These aren't rookie mistakes — they're assumptions made by successful entrepreneurs and executives who simply haven't run the numbers on tax-free growth. Let's dispel these costly myths:

"I'll be in a lower tax bracket in retirement." My successful real estate investors rarely are. Between Social Security, RMDs from other accounts, and rental income, many face higher rates than expected. Don't assume: calculate.

"The tax deduction today is worth more." This short-term thinking ignores the power of compound growth. Real estate in a Roth SDIRA compounds tax-free for decades, often producing 10x or more in tax savings versus today's deduction.

"It's too complicated." The compliance requirements are identical for both account types. The only difference is when you pay taxes — now with known rates, or forever with unknown future rates.

Your Next Strategic Move

The decision between traditional and Roth SDIRAs for real estate isn't just about tax rates. It's about wealth preservation and building sustainable wealth that transfers effectively across generations while maintaining your family's financial independence.

The complexity of self-directed IRA real estate investing requires expertise. You absolutely need an expert to help you navigate prohibited transactions and proper structuring. But once established, the difference between tax-deferred and tax-free growth becomes the difference between sharing your returns with the IRS and keeping every dollar your investments generate.

How Chicago Trust Administration Services Can Help

At Chicago Trust Administration Services, we've guided thousands through these critical decisions. We understand both opportunities and compliance requirements for SDIRA real estate investing, helping you see beyond immediate transactions to long-term wealth-building potential.

To explore whether Roth SDIRA real estate investing aligns with your wealth-building goals, I invite you to schedule a complimentary meeting with us by calling 312-869-9394 or emailing steve@ctasira.com.

Frequently Asked Questions (FAQs)

Q: What if I earn too much to contribute to a Roth IRA?

A: High earners can use a "backdoor Roth" strategy. For SDIRA real estate investors, this keeps the door open regardless of income level.

Q: Can I move my existing rental property into a Roth SDIRA?

A: No, you cannot transfer personally-owned property into any IRA; that's a prohibited transaction. However, you can sell your personal property to contribute to a Roth SDIRA for new investments.

*The content and opinions in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

**CTAS professionals are not financial advisors and cannot provide advice or recommendations regarding specific investment decisions.