Your Complete Year-End Self-Directed IRA Checklist: Gain Strategic Positioning for 2026

Key Takeaways

Sophisticated SDIRA investors conduct comprehensive year-end reviews to evaluate asset performance, ensure compliance, and position for the coming year's opportunities.

Most compliance violations are preventable by ensuring all income and expenses flow through the IRA account and maintaining arms-length relationships.

Strategic positioning includes identifying underperforming assets for reallocation, ensuring adequate liquidity, and utilizing an experienced self-directed IRA custodian.

If you're reading this, you're probably not the type of investor who sets up a retirement account and forgets about it. You've taken control through a self-directed IRA and understand that alternative investments require active, strategic oversight.

With another year coming to a close, now is the time to conduct a comprehensive review of your SDIRA holdings. In my experience working with sophisticated investors for over 30 years, those who build lasting wealth make year-end portfolio reviews non-negotiable.

Use this resource to ensure your investments remain compliant, your strategy stays aligned with your goals, and you're positioned to seize opportunities in the coming year.

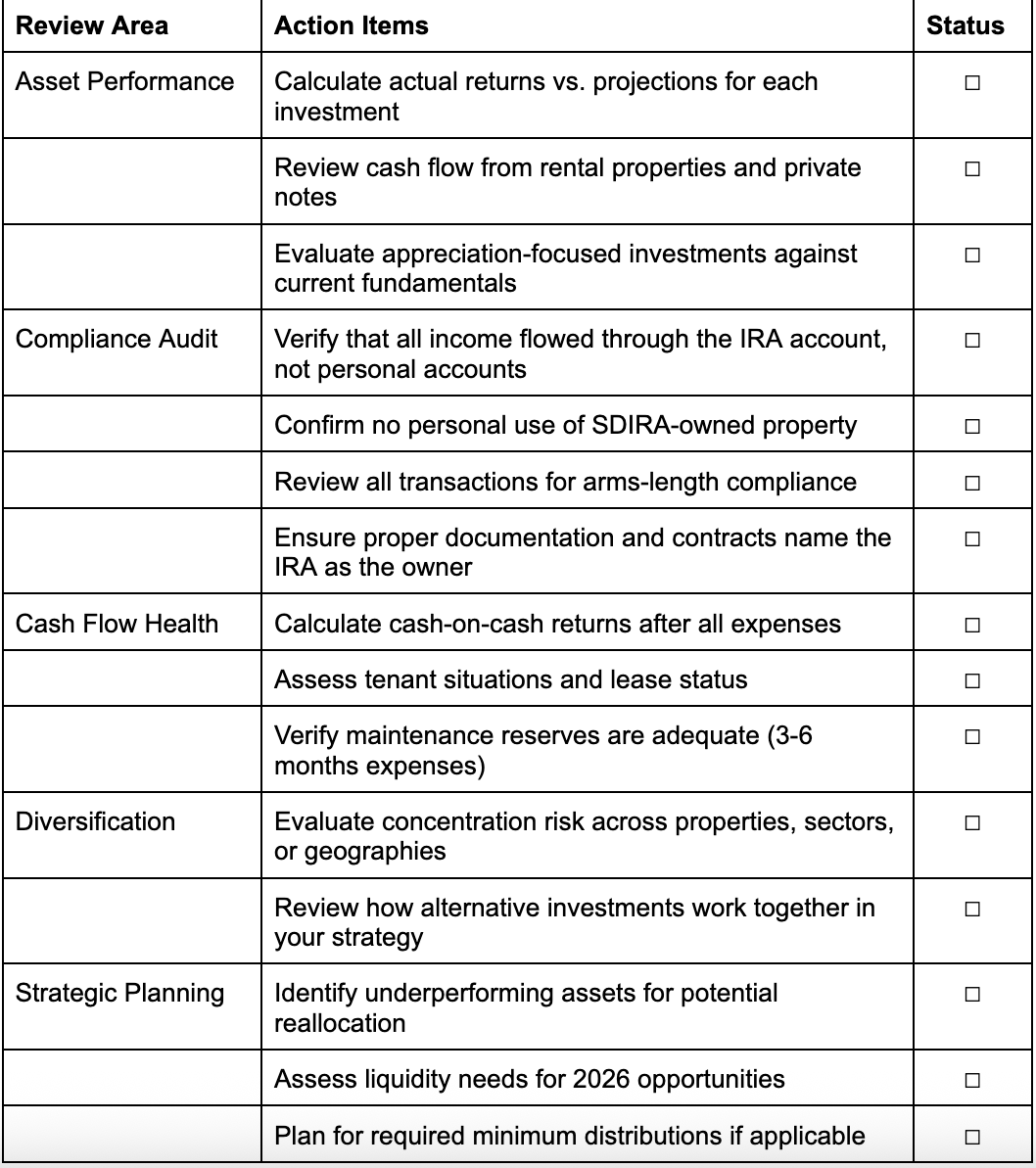

Your Year-End SDIRA Review Checklist

Before we break down the details, here’s a practical checklist you can use to guide your year-end review:

Now let’s walk through each area in detail.

Evaluate Asset Performance with Clear Eyes

Start by looking at each investment in your SDIRA individually:

How did your real estate properties perform?

Are your cash flow investments generating expected returns?

Did your private equity positions meet projections?

I've watched too many investors hold onto underperforming assets because they feel emotionally attached. If an asset consistently underperforms or no longer aligns with your strategy, consider reallocation.

For cash flow investments like rental properties or private lending notes, review actual returns against initial projections. For appreciation-focused alternative investments, evaluate whether fundamentals still support your thesis.

Use these insights to make informed decisions about what stays, what goes, and where to deploy capital next.

Prevent Compliance Issues Before They Happen

The IRS won't accept "I didn't know" as an excuse for prohibited transaction violations. Most compliance violations are entirely preventable when you understand the rules and structure transactions properly from the start.

The biggest risk involves prohibited transactions with disqualified persons–any transaction between your SDIRA and yourself, your spouse, lineal descendants/ascendants, or entities you control. Maintaining arms-length transactions is particularly important for real estate or private business holdings.

Here's how to structure your investments to avoid problems:

For rental properties:

All income flows directly to your IRA account through your property manager.

All expenses are paid from the IRA account; never covered personally.

You never personally use the property under any circumstances.

Third-party property management handles all operational decisions.

For business investments:

You can be a passive investor, but you cannot provide services or receive compensation beyond your proportional ownership share.

All contracts must clearly identify the IRA as the owner.

Independent managers make decisions, not you personally.

One example: I worked with a client who nearly lost his IRA's tax-advantaged status because he stayed one weekend at his SDIRA-owned rental property "just to check on renovations." That seemingly innocent action could have disqualified his entire IRA.

What to do if you discover a potential compliance issue:

Contact your self-directed IRA custodian immediately

Document exactly what occurred and when

Determine whether corrective action is possible

Consider voluntary IRS disclosure through the Voluntary Correction Program

Work with your custodian and tax advisor to develop a remediation plan

Some violations can be corrected if addressed quickly, particularly within the same tax year. Early disclosure typically yields better outcomes than waiting for IRS discovery.

Assess Cash Flow Investment Health

Cash flow investments provide predictable income but require active management. For rental properties, calculate your actual cash-on-cash return after accounting for vacancies, property management, maintenance, taxes, and insurance. Confirm you're maintaining 3-6 months of property expenses in cash reserves.

For private lending notes, verify all payments remain current. If a borrower has missed payments or requested modifications, address it now rather than letting problems compound.

Review Alternative Investments Diversification

Alternative investments give you control beyond traditional markets, but that diversity only works if it's intentional. Are you over-concentrated in a single property type, geographic area, or asset class?

Residential rentals all in the same metro area create risk if the local economy weakens. Multiple private lending deals in the same sector are a concentration disguised as diversification. True diversification means exposure across different asset types, geographies, and economic drivers.

Position for Strategic Opportunities in 2026

If you've identified underperforming assets for sale, start that process now — real estate transactions can take months. Consider whether your current allocation aligns with your goals and whether it's time to rebalance.

Consider your liquidity needs. Do you have enough cash to fund new opportunities? My most successful clients use year-end planning to identify target opportunities in December, so they're ready to act in the new year.

Partner with a Consultative Self-Directed IRA Custodian

The complexity of self-directed IRA investing makes working with an experienced custodian essential.

At Chicago Trust Administration Services, we take a consultative approach with our clients. We've helped thousands of sophisticated investors structure compliant SDIRA transactions over the past 20 years. We understand the nuances of real estate investments, private equity structures, and other alternative assets that most large institutional custodians don't handle well.

Working with us means working directly with professionals who understand your goals and can help you avoid costly mistakes. To see how we can help, we invite you to schedule a complimentary meeting with us by calling 312-869-9394 or emailing steve@ctasira.com.

Frequently Asked Questions (FAQs)

Q: My SDIRA has grown significantly this year. Should I be concerned about concentration risk?

A: Strong growth in one asset class often creates unintentional concentration. If a single investment or asset type now represents more than 40-50% of your SDIRA value, consider strategic rebalancing.

Q: How does year-end affect my SDIRA contribution limits for 2025 vs. 2026?

A: You can contribute to your 2025 SDIRA until the tax filing deadline. However, if you're planning major investments in early 2026, consider maximizing your 2025 contributions before year-end to increase available capital.

Q: Should I review my SDIRA beneficiary designations during my year-end review?

A: Absolutely. Life changes like marriages, divorces, births, or deaths require beneficiary updates. Outdated beneficiaries can create significant tax complications and unintended inheritance outcomes.