I Inherited an IRA...Now What? Your Guide to IRA Beneficiary Rules

Key Takeaways

The inherited IRA 10-year rule gives you flexibility. You don't have to liquidate immediately.

Immediate liquidation usually costs six figures in below-market sales, concentrated taxes, and forfeited cash flow.

Prohibited transaction rules still apply to you as a beneficiary. Violations make the entire IRA immediately taxable.

CTAS educates on assets and compliance; your financial advisor and CPA guide distribution strategy.

The phone call usually comes within the first week.

“Steve, I just inherited my father’s self-directed IRA. I see rental properties, some private equity positions, and honestly, I don’t understand any of it. Can you just liquidate everything and send me a check?”

I understand the impulse. You’re grieving. You’re managing an estate while untangling dozens of financial and legal matters. The last thing you want is to take on faraway rental properties or unknown private equity positions.

But before you make any hasty decisions about inheriting an IRA, here’s what you need to know.

What It Actually Means to Inherit a Self-Directed IRA

You haven’t just inherited an account number, but actual assets that require management decisions.

Unlike traditional IRAs, which hold stocks and bonds that you can sell with one click, self-directed IRAs hold more illiquid alternative investments: rental properties with tenants and property managers, private equity positions with lock-up periods, mortgage notes with payment schedules, or partnership interests with operating agreements.

Your benefactor chose these investments for diversification, cash flow, and appreciation. They spent years, sometimes decades, building this portfolio intentionally. Part of honoring that effort means not rushing to decisions when you inherit their IRA.

The Inherited IRA 10-Year Rule Explained

Under the SECURE Act, most non-spouse beneficiaries must withdraw all funds from an inherited IRA within ten years of the original owner’s passing. This is the inherited IRA 10-year rule.

You have complete flexibility in when to take distributions. Year one, spread evenly, wait until year ten, or any pattern in between. The only requirement: empty by year ten.

Spouse beneficiaries have different options: they can treat the IRA as their own, roll it into their existing IRA, or take it as an inherited IRA with more favorable beneficiary distribution rules.

The tax implications matter significantly. If you inherited a traditional self-directed IRA, every dollar you withdraw is taxable income at your current tax rate. If you inherited a Roth self-directed IRA that’s been open for at least five years, all distributions are completely tax-free.

Why Immediate Liquidation Usually Costs Six Figures

Most beneficiaries want to liquidate their inherited SDIRA assets immediately for understandable reasons.

The assets may feel unfamiliar, so keeping cash seems like the safer choice. Alternative investments often require more ongoing attention than you're ready to commit to. Or perhaps you need quick access to funds for estate costs or your own financial priorities.

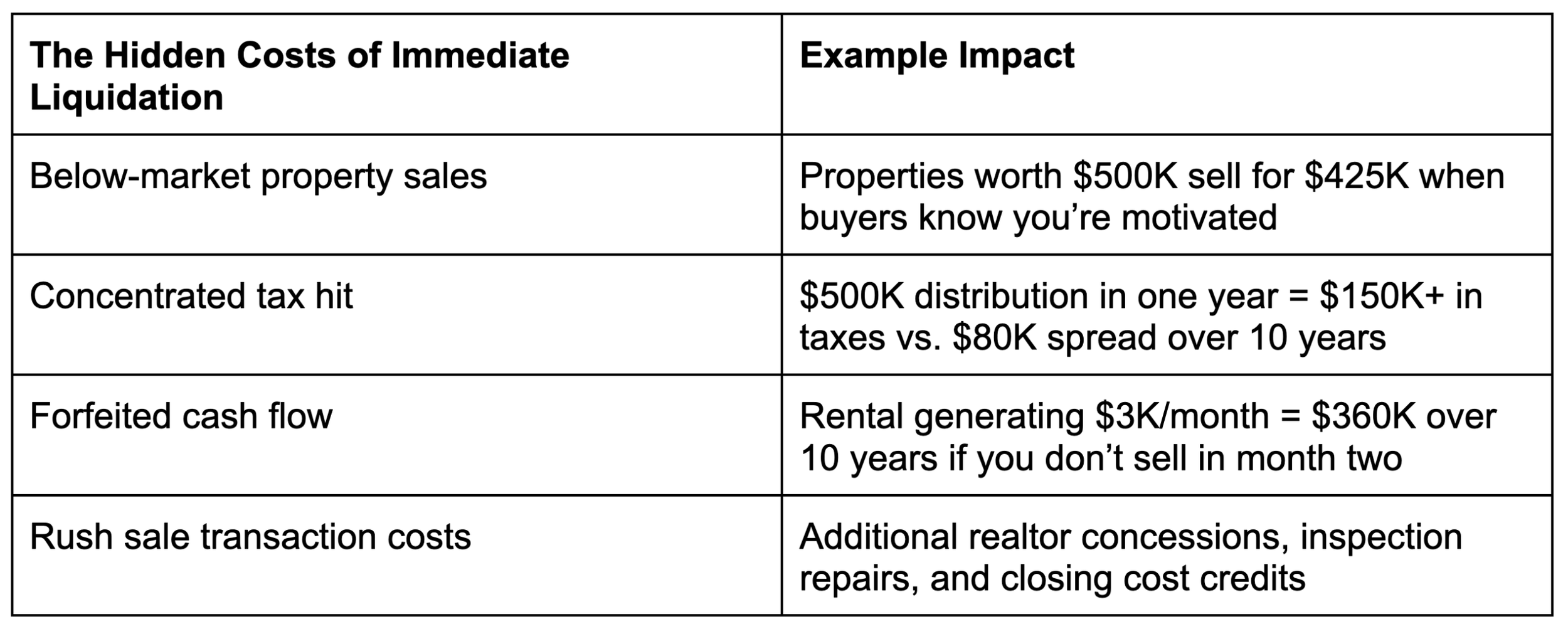

But rushing to cash out usually costs hundreds of thousands of dollars. Here’s how:

The 10-year timeline isn’t a burden but an opportunity to maximize what you inherit.

The Compliance Requirements That Still Apply to You

The prohibited transaction rules that applied to your benefactor still apply to you, and that catches many beneficiaries off guard.

You cannot live in inherited IRA properties.

You cannot hire yourself or family members for property management.

You cannot use inherited IRA assets for personal benefit.

You cannot mix personal funds with IRA funds.

All property expenses must be paid from the IRA. All rental income must flow back into the IRA. Any violation of these rules causes the entire inherited IRA to lose its tax-advantaged status immediately, meaning the full balance becomes taxable.

At Chicago Trust Administration Services, we educate beneficiaries on these compliance requirements and walk them through their inherited assets. We explain the beneficiary distribution rules and facilitate distributions according to IRS guidelines.

What we cannot do, and this is crucial to understand, is tell you what to do with the investments. We’re not financial advisors. The decision about whether to hold or sell specific assets belongs to you and your advisory team.

What You Need to Know Before Selling Anything

What was the benefactor's investment strategy? Ask us, the estate attorney, or family members who might know.

Are these assets producing income? Strong cash flow might justify keeping them temporarily.

What are the tax implications? Your CPA can model taking distributions now versus spreading them out.

Are there contractual obligations or lock-up periods? Some positions have exit restrictions.

What's the realistic timeline for selling? Real estate takes months, not days.

Who should I consult? CTAS for compliance education, your financial advisor for strategy, and your CPA for tax planning.

Use the 10-Year Window Strategically, Not Emotionally

Take the time to understand what you’ve inherited before making irreversible decisions. The 10-year rule offers flexibility and time that can be used to your advantage.

Schedule a meeting with us to review the assets and compliance requirements. Assemble your advisory team. Develop a distribution strategy that considers your tax situation, the realistic timeline for selling various assets, and your own liquidity needs.

The most expensive mistakes happen in the first 90 days when beneficiaries act on emotion instead of information. A few weeks of education can save you hundreds of thousands of dollars over the next decade.

A Note to Current SDIRA Owners Reading This

If you're a current self-directed IRA owner, this is what your heirs will face.

Don't let them struggle without preparation. Document your strategy now. Educate your heirs and introduce them to your professional team while you're here to explain your thinking.

The gap between your vision and their understanding costs families hundreds of thousands in rushed liquidations. See my recent article for you here.

At Chicago Trust Administration Services, we work with both beneficiaries navigating inherited SDIRAs and current owners planning for successful wealth transfer. Wherever you may be, we invite you to schedule a complimentary meeting with us by calling 312-869-9394 or emailing steve@ctasira.com.

Your inherited wealth deserves strategic thinking, not panic decisions.

Frequently Asked Questions (FAQs)

Q: What if there are multiple beneficiaries on the inherited IRA?

A: Each beneficiary typically receives their percentage as a separate inherited IRA account. This allows you to make distribution decisions independently. One sibling can liquidate immediately while another holds assets longer based on individual circumstances.

Q: What happens to an inherited IRA if I pass away before emptying it?

A: The remaining balance passes to your estate or designated successor beneficiary, but the original 10-year timeline still applies from the original owner's passing. Planning for this contingency is important if you have significant assets.

Q: Can I disclaim my inherited IRA if I don't want it?

A: Yes, you can disclaim (refuse) an inherited IRA within nine months of the original owner's passing. The assets then pass to the contingent beneficiaries. This is sometimes done for estate planning or tax reasons, but requires careful consideration with an estate attorney.

*The content and opinions in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

**CTAS professionals are not financial advisors and cannot provide advice or recommendations regarding specific investment decisions.